update on mn unemployment tax refund

Check For The Latest Updates And Resources Throughout The Tax Season. Paul MN 55146-5510 Street address for deliveries.

Details On Recouping Ui Taxes Frontline Worker Bonuses Minnesota Chamber Of Commerce

2022 Base Tax Rate changed from 050 to 010 2022 Additional Assessment changed from 1400 to 000.

. Minnesota Department of Revenue Individual Income Tax. Your tax return has errors. New look - employer account.

How they affect you. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill.

As a result jobless benefits up to 10200 for individuals earning less than 150000 per year are exempt from tax. Minnesota Department of Revenue Mail Station 5510 600 N. Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments.

Paul MN 55145-0020 Mail your tax questions to. 971 846 776 290. Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate.

Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th.

Unemployment 10200 tax. Federal and MN State unemployment tax refund. Some taxpayers whove accessed their transcripts report seeing different tax codes including 971 846 and 776.

IR-2021-159 July 28 2021. Taxpayers who had filed their tax returns earlier than the legislation and had already paid taxes including those benefits were going to get the unemployment tax refunds. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

The refunds totaled more than 510 million. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. IRS Unemployment Tax Refund Update.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in. 2014 Tax Rate Reduction for Employers. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. Finally The Checks Start Showing Up. File unemployment tax return.

We know these refunds are important to those taxpayers who have. September 15 2021 by Sara Beavers. 2022 New employer rates.

Report unemployment income to the IRS. This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits. 22 2022 Published 742 am.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Overview of tax rates. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks.

FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. Minnesota Unemployment Refund Update. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. Unemployment Insurance Tax changes. They fully paid and paid their state unemployment taxes on time.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. The Minnesota Department of Revenue. 61722 at 230 pm.

Minnesota Department of Revenue Mail Station 0020 600 N. Others are seeing code 290 along with Additional Tax Assessed and a 000 amount. Tax Transcript Codes.

Mail your property tax refund return to. The unemployment tax refund is only for those filing individually.

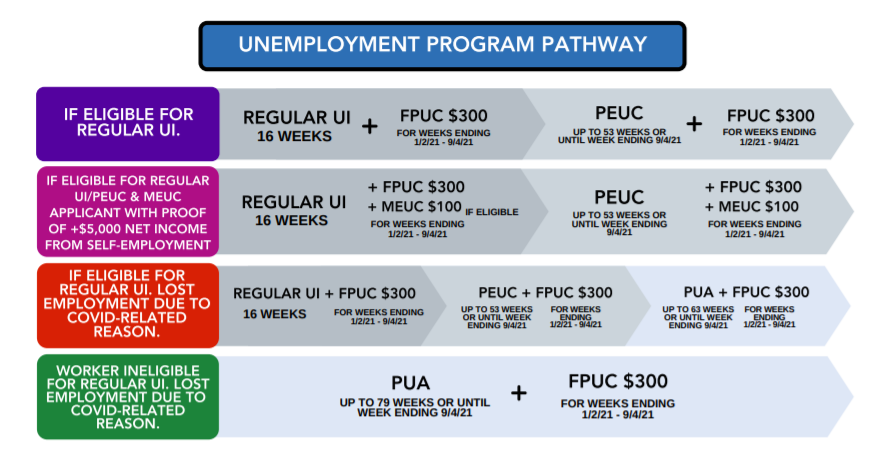

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Compensation Are Unemployment Benefits Taxable Marca

667k Minnesotans To Get Pandemic Hero Pay Business Unemployment Tax Increase Reversed Twin Cities

When Will Irs Send Unemployment Tax Refunds 11alive Com

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Who Gets Mn Hero Pay And How Unemployment Tax Hike Is Returned

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Where S My Refund Minnesota H R Block

A New Look Is Coming To Your Minnesota Unemployment Insurance Account Employers Unemployment Insurance Minnesota

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

State Income Tax Returns And Unemployment Compensation

Mn Revises 2022 Unemployment Insurance Tax Rates Paylocity

Ppp Ui Tax Refunds Start In Minnesota

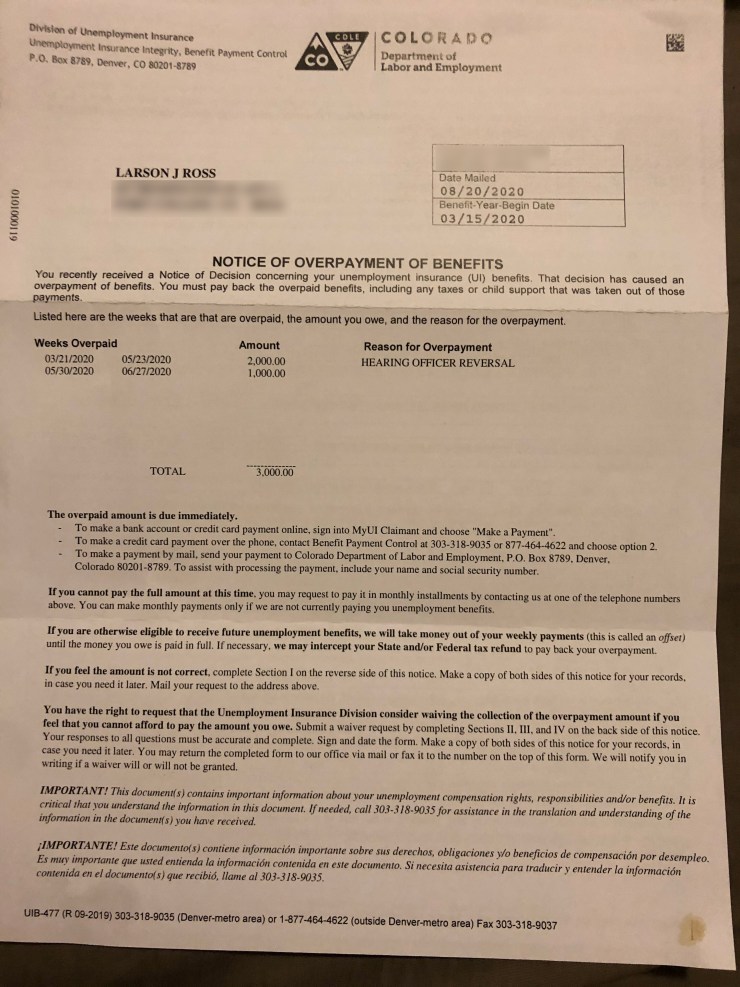

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace